THE CURRENT STATUS OF THE BRAZILIAN AGRICULTURAL AND LIVESTOCK SECTOR UNDER CARBON MARKET OUTLOOK: CHALLENGES AND OPPORTUNITIES

Viviane Torinelli (FDC), Luan Santos (UFRJ), Carolina Grangeia and Sofia Carra, experts from the Brazilian Alliance for Sustainable Finance and Investments (BRASFI).

Introduction

During the 26th United Nations Conference of the Parties on Climate Change (COP26) in Glasgow, an agreement related to Article 6 was reached, which created an important environment for international cooperation. It integrates the private sector with carbon market and non-market approaches, enabling climate ambition to rise and meet emission targets (1). However, there are still many uncertainties regarding instruments, in addition to aspects that need to be detailed in the carbon markets (2). At the same time, carbon-pricing instruments are being increasingly implemented, while the previously timid voluntary market is gaining strength, especially with recent commitments made by the private sector (3).

In this context, Brazil has a strategic and fundamental role to play. The country stands out internationally for having developed the third-largest number of Clean Development Mechanism (CDM) projects and being the fourth-largest issuer of CERs (Certified Emission Reductions). Furthermore, the country actively participates in the voluntary carbon market, occupying the fourth position in carbon credits generated (4).

Therefore the discussion about a national carbon market regulation is increasingly accelerated and gaining new contours. Federal Decree No. 1075/2022 (5) was recently released and defines the Brazilian Emissions Reduction Market (Mercado Brasileiro de Redução de Emissões – MBRE), which was determined by the National Policy on Climate Change (PNMC, in Portuguese) (6). Although it has already presented significant advances, there are still many gaps and uncertainties regarding the regulation and design of the MBRE instruments and what will be the reflexes in the economic sectors (7).

However, there is little expressiveness in the carbon markets of a dominant sector in activity and economic results in Brazil, the agricultural sector. Agriculture, forest and energy are the sectors that present the greatest opportunity in the context of carbon markets in the country. Even with uncertainties regarding market regulations, the agricultural sector presents opportunities that include the potential for financial gains and international transfers of mitigation, with a financial return for the country, as well as the transition to a more sustainable agricultural system (3).

In this context, this article seeks to explore the opportunities and challenges of including the Brazilian agricultural sector in carbon markets, considering their current status.

Sector overview – The Brazilian Agribusiness

Brazilian agribusiness plays an important role in the global food supply. The country is one of the largest producers and exporters of food, mainly meat, grains and forest products, which reach more than 800 million people worldwide (8). Moreover, the agribusiness sector represents 27.4% of Brazilian GDP (9) and it also plays an important social role, employing more than 9% of the population (10), with 67% of the workforce composed of smallholder farmers (11). The success of the Brazilian agribusiness sector is the result of investments in science, technology and innovation, which allowed the development of tropical agriculture. In the last 49 years, grain production increased by 797% without expanding the planted area in the same proportion (187%) (11).

Due to the high productivity of Brazilian agribusiness, the international agenda increases the demand for more sustainable practices in the food sector. The impacts that the world has been facing caused by climate change demand a new urgent look at food production considering the vulnerability of the sector and its contribution to GHG emissions. In Brazil, the agricultural and livestock sectors represent 27% of the country's emissions, and together with changes in land use and forests, it accounts for 73% (12). The transition to a more sustainable food system has been supported by international agendas, such as the Sustainable Development Goals (13) and international agreements.

Despite the high contribution of Brazilian agribusiness to the country's total emissions, new production arrangements and techniques, based on the expertise of agriculture developed in the tropics, have been developed to combine productivity, reduce GHG emissions and increase carbon sequestration. Agroforestry systems, no-tillage systems, biological nitrogen fixation, and integrated production systems, such as the Integrated Crop-Livestock-Forestry Systems (ICLFS) and its variations, are emblematic techniques developed and adapted for the tropical agriculture. The ICLFS gave rise to the "carbon neutral meat" stamp (14), which certifies beef cattle production under integration systems.

The techniques already mentioned, along with the recovery of degraded pastures and livestock waste treatment, were included in the "Sectoral Plan for Adaptation to Climate Change and Low Carbon Emissions in Agriculture 2010-2020", entitled "ABC Plan". The sectoral plan was established in compliance with the PNMC (6), and it was consolidated as the most important national public policy to promote low-carbon agriculture in Brazil. Although the amount of financial support was considered lower than necessary to meet the ABC Plan goals, it contributed to the reduction between 100.21 and 154.38 million MgCO2 equivalent between the years 2010-2018 contributing significantly to the national commitments to the reduction of emissions by 2020 (15).

The ABC Plan was reviewed and improved for the period between 2020-2030. It is called ABC+ Plan and aims to adopt strategies that increase the adaptive capacity of the sector in the face of climate change, with a mitigation capacity equivalent to 1,042.41 million of Mg CO2eq (16). It has three strategic pillars: (i) the Integrated Landscape Approach: (ii) GHG mitigation and adaptation, and (iii) encouraging the adoption and maintenance of Sustainable Production Systems, Practices, Products and Processes.

Despite the innovations aiming the climate change adaptation and GHG emissions control in the agricultural sector, there are still many challenges to developing low-emission agriculture in Brazil. However, the interest of the national and international financial and business sector in the sustainable agenda is notable due to the sector's global relevance to the country's economy and food security. In this context, an increase in net-zero commitments has been observed which includes a look at the supply chain and greater transparency on climate information as presented, for instance, within the scope of the Task Force to Scale Voluntary Carbon Markets (Taskforce on Climate-Related Financial Disclosures – TCFD1) and even the speculative interest in the purchase of credits by investors (17).

Also, global initiatives are emerging to guide these sectors in achieving their goals, such as the Science-Based Targets Initiative (SBTi), which seeks to mobilize companies to adopt science-based targets to reduce their GHG emissions (18), and the Oxford Principles for Offsetting, which seek to guide the private sector in the use of carbon credits (19).

There are also initiatives supported by investors, such as the "Investors Policy Dialogue on Deforestation – IPDD", which aims to engage the government and companies in the fight against deforestation in search of the financial sustainability of investments in the long term (20). Additionally, multisectoral initiatives stand out, such as the Voluntary Carbon Markets Integrity Initiative, which aims to ensure that voluntary carbon markets make significant, measurable contributions in line with established goals (21) is also an example.

These initiatives contribute directly and indirectly to those who seek to act with transparency, for example, in the scenario of exports of Brazilian products and have a greater alignment of guidelines for disclosure. Such initiatives make Brazilian production and products more credible on the international scene, ensuring potential improvements in the trade balance and practices aligned with the ESG (Environmental, Social and Governance) agenda and contributing to the Brazilian NDC and other international commitments signed.

Therefore, integrating the good practices and innovations of the Brazilian agricultural sector that drive the reduction of GHGs emissions and/or the increase of carbon sequestration can attract international investments and open a large window of opportunity for the sector. There is still a gateway to carbon markets, which will be explored in the next session.

Risks, challenges and opportunities for the Brazilian agricultural and livestock sector in carbon markets

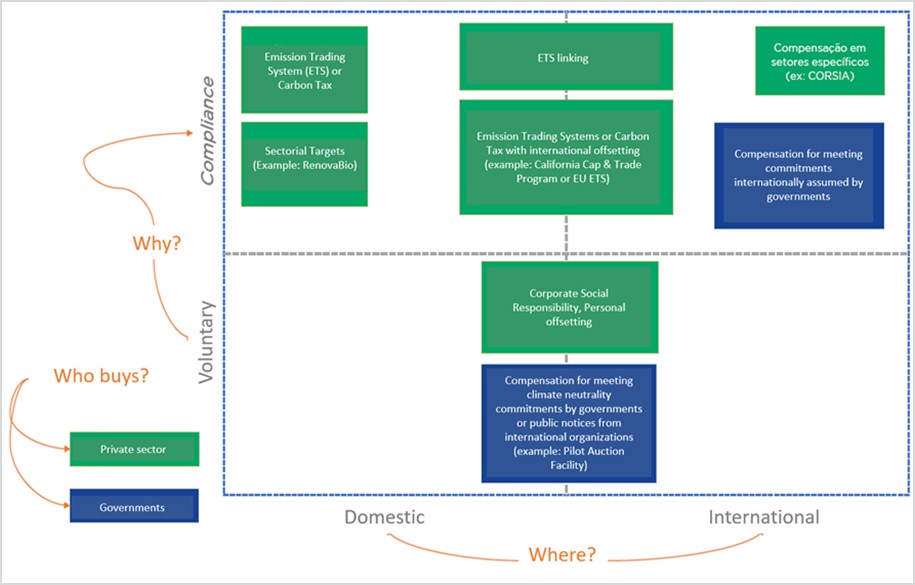

This chapter advocates an understanding of carbon markets. It is possible to verify the mandatory/regulated approaches and the voluntary initiatives (Figure 1). In general, carbon pricing from the perspective of the regulated market seeks to encumber emitting sources by negative externalities, configuring itself with a "firm" demand for mitigation. On the other hand, voluntary initiatives have a demand sustained by the intention to remunerate non-regulated agents for the mitigation of emissions (22). The approaches are complementary, as the offer of carbon credits generated in the voluntary environment can help achieve regulatory goals and commitments by offsetting (called offsets), reducing the cost of control by regulated agents and increasing the cost-effectiveness of mitigation aggregated by the two mechanisms (18; 23).

Figure 1: Typology of carbon market demand

Source (22)

A recent study on the voluntary carbon market in Brazil, carried out by FGV (4), points out that the volume of carbon credits generated in the voluntary market increased by 236% in 2021 compared to 2020, with an emphasis on energy (63%) and Agriculture, Forestry, and Other Land Use (AFOLU) (25%) projects. However, the volume of credits generated by projects related to the AFOLU sectors is significantly higher than credits from energy (73% and 24%, respectively, in 2021). Despite the carbon credits emitted from AFOLU projects growing 8 times in 2 years, these are mostly related to the forestry sector. In addition to the small share of registered projects and the respective credits generated in the agricultural sector, these are limited to the methodology of methane recovery in livestock activity (4).

Another investigation carried out by ICCBrasil and Waycarbon (3) estimated the potential for generating carbon credits in the Brazilian agricultural sector between 10 and 90 MtCO2e by 2030. Considering the agriculture and forest sectors, Brazil has the potential to supply between 5% and 37.5% of the world's demand in the voluntary market.

In terms of regulated markets, since 2009, the PNMC (6) has provided an institutional environment for structuring a Brazilian ETS mechanism. Since then, the ABC Plan (and its new version, ABC+ Plan) emerged, the Forest Code was updated (23), Payments for Environmental Services (24) were facilitated, and a significant increase in REDD+ projects was observed. Thus, an interesting framework was created to guide the implementation of a market instrument (25). Despite the Federal Decree 11075/2022 (5) does not define which sectors are going to compose the regulated market, the agricultural sector is mentioned in Art. 11 of PNMC (6), which suggests its participation. If the agricultural sector is confirmed in this market, the next step will be the definition of the Sectorial Agreement for the Reduction of GHG Emissions. At this point, it is important to highlight that in the international scenario, the agricultural sector itself is not considered in any regulated carbon market (26).

According to Art. 5 of the Federal Decree 11075/2022 (5), the sectorial agreement consists of "an instrument that defines the trajectory of GHG emissions reduction by sector of the economy, contributing to Brazilian climate neutrality and the National Emission Reduction Targets". In this sense, Brazil currently has a "Sectoral Plan for Adaptation to Climate Change and Low Carbon Emissions in Agriculture 2010-2020", entitled "ABC Plan". It was established in compliance with the PNMC (6) and is consolidated as the main national public policy to promote low-carbon agriculture. Although the amount invested was considered to be far below what was necessary to meet the established goals, between the years 2010-2018, the ABC Plan made it possible to reduce between 100.21 and 154.38 million MgCO2 equivalent contributing significantly to national emission reduction commitments by 2020 (15).

In this sense, the "Mitigation Options" project, an initiative of the Brazilian Ministry of Science, Technology and Innovation (MCTI) (27), estimated abatement2 potentials and costs related to the measures adopted by the agricultural sector. Strategies for the intensification of beef cattle, which include the recovery of degraded pastures, the fertilization of pastures and confinement, correspond to 98% of the potential abatement in the sector, requiring investments of around US$ 4.7 billion (3). On the other hand, integrated systems strategies such as ICLFS and biological nitrogen fixation showed potential for generating net income (26). Therefore, it is important to note that these strategies and technologies are included in the ABC+ Plan (16).

Despite the actions embraced in the ABC+ Plan present advances, a great difficulty continues to be the accreditation and the costs related to the MRV. It can be mainly due to the heterogeneity of soils and climates in Brazil and the reliability and precision of the available and reported information (28; 25). Another challenge is the integration of smallholder farms in the Plan (29). Looking at these issues, the ABC+ Plan (2020-2030) seeks to enable MRV mechanisms aligned with internationally accepted criteria, thus promoting economic incentives and market instruments to remunerate sustainable production systems in the sector (3; 16).

Brazil has sought to move forward with the agenda of good practices in agribusiness, and a well-structured regulated market is interpreted as positive for the national scenario, when the Federal Decree, for example, mentioned the possibility of recording a carbon footprint; carbon from native vegetation and carbon in the soil (including rural producers and the more than 280 million hectares of protected native forest) and blue carbon (5). On the other hand, it is important to consider the heterogeneity of the sector and the actors involved in the supply chain to create a consistent and cost-effective ecosystem for GHG mitigation.

Nonetheless, it should be noted that the design and operation of the MBRE are still unclear, such as the role of command and control instruments (regulatory, legal), one of the major gaps when it comes to the need for greater inspection and control.

Conclusions e Policy Implications

The numbers presented show that the Brazilian agricultural sector opportunities are observed in both markets (regulated and voluntary). Brazil plays an important role in the climate agenda, assuming an active and protagonist position in the search for international financing opportunities for mitigation and adaptation projects. An example, for instance, is the implementation of carbon pricing instruments, and the definition of how to regulate the domestic trading environment and foster dialogue with the international market, which is currently underway.

In this regard, the country presents significant comparative advantages in the AFOLU sectors, given the generation of carbon credits in recent years and the implementation of a sectoral plan that promotes sustainable production systems, practices, products and processes in addition to the implementation of the MRV in line with international criteria, which can foster credibility for Brazilian products. However, there are still many challenges in the AFOLU sector without REDD+, which go through regulatory and legislative issues, especially techniques on making the potential of tropical agriculture tangible, consolidating an environment that encompasses the entire value chain and methodologically inserting itself into the international scenario.

Therefore, in order to scale carbon pricing instruments in the Brazilian agricultural sector, it is necessary that the carbon pricing instruments bring socio-environmental co-benefits, which will be evidenced to the most skeptical farmers, and that the projects respect the principles of integrity, also highlighting the role of carbon finance. Investments in research and development of technologies for measuring carbon considering the characteristics of the Brazilian agriculture and livestock sector as well as support from the public sector for engagement and technical training with the private sector and producers, are also crucial. Furthermore, it is necessary to reduce MRV costs and make the implementation of projects more tangible. The generation of carbon credits can be a way to leverage sustainable technologies for primary production.

Therefore, further development of discussions about MBRE's operationalization and the reflexes in the entire value chain of the agricultural sector is needed, including exports, understanding that greater adoption of sustainable production practices can leverage the national carbon market and its integration into the global ecosystem. Thus, the aim is to attract financial incentives and economic and reputational gains for the sector, guarantee social co-benefits, increase income, production efficiency and food security, and encourage conservation and environmental integrity with positive GHG mitigation results.

- The private sector-led effort to scale voluntary carbon markets, with reporting and disclosure actions and guidelines based on established initiatives such as SBTi, Oxford Principles, GHG Protocol and ISO.

- When the cost is negative, it is understood that mitigation incurs net benefits, that is, in addition to enabling a reduction in CO2e emission, it provides financial return over the useful life of the technology and/or horizon of implementation of the low carbon activity. On the other hand, if the cost is positive, mitigating emissions will require a financial effort for the agent, except through carbon pricing in the market (3).

References

- https://unfccc.int/process/the-paris-agreement/cooperative-implementation#:~:text=UNFCCC%20Nav&text=Article%206%20of%20the%20Paris,sustainable%20development%20and%20environmental%20integrity. Accessed on May 31, 2022.

- https://valorinveste.globo.com/blogs/caroline-prolo/coluna/como-vao-funcionar-os-mercados-de-carbono-do-artigo-6-do-acordo-de-paris.ghtml

- https://www.iccbrasil.org/media/uploads/2021/10/13/estudo-de-oportunidades-para-o-brasil-em-mercados-de-carbono_icc-brasil_2021_vf.pdf

- https://eesp.fgv.br/sites/eesp.fgv.br/files/ocbio_mercado_de_carbono_1.pdf

- http://www.planalto.gov.br/ccivil_03/_ato2019-2022/2022/decreto/D11075.htm

- http://www.planalto.gov.br/ccivil_03/_ato2007-2010/2009/lei/l12187.htm

- https://epbr.com.br/mercado-brasileiro-de-carbono-analises-e-perspectivas-em-um-ambiente-de-inseguranca-juridica-e-regulatoria/

- https://www.embrapa.br/busca-de-noticias/-/noticia/59784047/o-agro-brasileiro-alimenta-800-milhoes-de-pessoas-diz-estudo-da-embrapa

- https://www.cepea.esalq.usp.br/br/pib-do-agronegocio-brasileiro.aspx

- https://www.cepea.esalq.usp.br/br/releases/mercado-de-trabalho-cepea-em-2021-populacao-ocupada-no-agronegocio-atinge-maior-contingente-desde-2016.aspx#:~:text=Desse%20modo%2C%20a%20participa%C3%A7%C3%A3o%20do,18%2C46%20milh%C3%B5es%20de%20pessoas.

- https://www.cepea.esalq.usp.br/br/pib-do-agronegocio-brasileiro.aspx

- https://www.embrapa.br/en/embrapa-em-numeros>

- https://seeg-br.s3.amazonaws.com/Documentos%20Analiticos/SEEG_9/OC_03_relatorio_2021_FINAL.pdf

- https://sdgs.un.org/goals

- https://www.embrapa.br/en/busca-de-publicacoes/-/publicacao/1056155/carne-carbono-neutro-um-novo-conceito-para-carne-sustentavel-produzida-nos-tropicos

- https://www.agroicone.com.br/wp-content/uploads/2020/10/Agroicone-Estudo-Plano-ABC-2020.pdf

- https://www.gov.br/agricultura/pt-br/assuntos/sustentabilidade/plano-abc/arquivo-publicacoes-plano-abc/final-isbn-plano-setorial-para-adaptacao-a-mudanca-do-clima-e-baixa-emissao-de-carbono-na-agropecuaria-compactado.pdf

- Katie Sullivan, Antoine Diemert, Carlos Cordova, Joseph Hoekstra, Constanze Haug, Stephanie La Hoz Theuer, Alexander Eden, Stefano De Clara, Victor Ortiz Rivera, Frank Schroeder, Daniel Peon. Status e tendências dos mercados regulados e voluntários de carbono na América Latina. 2021.

- https://sciencebasedtargets.org

- https://www.smithschool.ox.ac.uk/publications/reports/Oxford-Offsetting-Principles-2020.pdf

- https://www.tropicalforestalliance.org/en/collective-action-agenda/finance/investors-policy-dialogue-on-deforestation-ipdd-initiative

- https://vcmintegrity.org/wp-content/uploads/2021/10/Roadmap_Final.pdf

- Prolo, Penido, Santos, & La Hoz Theuer, 2021: Explicando os mercados de carbono na era do Acordo de Paris.

- http://www.planalto.gov.br/ccivil_03/_ato2011-2014/2012/lei/l12651.htm

- https://www.in.gov.br/en/web/dou/-/lei-n-14.119-de-13-de-janeiro-de-2021-298899394

- https://www.insper.edu.br/wp-content/uploads/2022/01/BrAgricultureCarbonPricing_Dec21.pdf

- https://icapcarbonaction.com/system/files/document/220408_icap_report_rz_web.pdf

- https://antigo.mctic.gov.br/mctic/opencms/ciencia/SEPED/clima/opcoes_mitigacao/Opcoes_de_Mitigacao_de_Emissoes_de_Gases_de_Efeito_Estufa_GEE_em_SetoresChave_do_Brasil html#:~:text=O%20Projeto%20%2D%20Op%-C3%A7%C3%B5es%20de%20Mitiga%C3%A7%C3%A3o,auxiliar%20a%20tomada%20de%20decis%C3%A3o

- https://ainfo.cnptia.embrapa.br/digital/bitstream/item/206622/1/Vicente-Agricultura-Carbono-2019.pdf

- https://www.agroicone.com.br/portfolio/agroicone-lanca-estudo-sobre-a-insercao-da-agricultura-familiar-no-plano-abc/